Games That Teach Financial Literacy & Money Activities for Kids

Many kids have a hard time understanding money. Despite the hurdle of basic math, there are many lessons about money that kids don’t learn until much, much later in their lives: saving money, budgeting, investing, and more. It doesn’t need to be this way, though!

There are many different games to teach financial literacy and even money activities for kids that can be used to better usher them into the world of finance.. We’ll cover our favorites here.

7 interactive money games that teach financial literacy and introduce important lessons

Monopoly

Monopoly, one of the more famed games that involve money, actually has a pretty ironic history. The original concept of Hasbro’s popular property-management board game belonged to progressive economist and game designer Elizabeth Magie, who patented her “Landlord’s Game” in 1903.

In reality, Monopoly rewards holding onto massive sums of money only sometimes. It’s definitely a sound strategy; having decent sums of money set aside is practical, giving yourself a safety cushion against unexpected expenses. However, this alone won’t decide the game.

With everyone starting at the same amount of money, kids will have to make their first purchases wisely. Randomly spreading money out over unrelated ventures won’t return the investment that focusing on a single prospect will. Being too stingy means you’ll just have to pay other players with more property later; related to this, you’ll miss opportunities to snatch up property for yourself.

The Game of Life

Money games for kids typically deal directly with budgeting, saving, and investing. However, The Game of LIFE is a game based around real-life scenarios. For many young children, this is their first reference to concepts such as having a career, savings, and even retirement.

This game is fantastic for teaching about the opportunities and responsibilities of adult life with children. Every lifestyle costs money—investment, starting a family, owning a business, free-wheeling it—and each comes with unique challenges and rewards which LIFE does a good job simplifying for a kid to understand and enjoy.

It’s not a game about the stress of bills and deadlines, but a game that celebrates the possibilities that money can give you. This teaches kids not to be afraid of financial hardship, but to plan ahead and tackle it head-on.

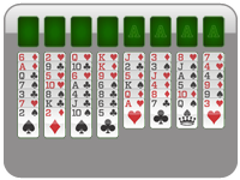

Solitaire

Solitaire, the classic solo card game, isn’t technically one of those games that involve money directly. However, it does affect financial literacy by cultivating critical thinking and the ability to evaluate multiple future approaches or directions. Solitaire games require organization, prioritization, and forward-thinking to succeed.

Prioritization is an especially important facet of Solitaire. The game is full of moves that may be technically sound in the short term but can have unintended consequences later on, potentially making the game more difficult. To navigate around this, encourage your child to map out the effects that a single move might have, and tell them if there are any they aren’t seeing.

Pay Day

Pay Day introduces kids to the very exciting concept of going broke. Payday is at the end of the month, and the goal is to be smart with your spending so you don’t find yourself in the red before your chance to win.

If you want to teach kids about money and the importance of saving it, this is one of the best games you can find. When young adults earn their first paycheck, their instinct is to instantly blow it on large purchases—then regret it later when bills arise. This game can not only teach your kids to save their money but to spend it smartly.

Exact Change

Almost everybody, at some point in their life, will need to stand behind a cash register and break a bill into some coins. That’s exactly what Exact Change is about. Unlike other money games for kids, this one is a speedy card game that plays a lot like UNO, teaching kids to play the exact change of different values. This game refreshes some very important foundational math with young children.

Animal Crossing

More into video games? Settle into one of Nintendo’s famous animal communities with Animal Crossing.

Essentially a life simulator, there’s a lot kids can do in Animal Crossing. Dig up fossils, enjoy a sunny day of fishing, learn about real-world wildlife, and so much more. Animal Crossing is a relaxing game all about appreciating the natural world around you, but the game does have a financial aspect. Namely, every player starts their Animal Crossing journey by taking out their very first mortgage, and the long-term goals of the game involve raising funds to pay off their debt.

Animal Crossing isn’t a stressful game, and players don’t accrue interest on their debts, but the game can be a very motivating example to teach kids about managing their spending over time to pay off their debt and enjoy the luxuries that this brings.

Many, many, many different apps

More and more, kids want digital games to play. There are so many apps out there that teach money skills, and it would be absurd to try to list them. However, despite games, there are plenty of educational apps that can teach kids about money. Here are some free stand-outs.

- Khan Academy Kids

- Quick Math Jr

- PBS Kids

5 easy, everyday financial literacy activities for kids

Games are great fun, but sometimes giving kids real-world activities can make them more confident around money and spending. Here are a few financial literacy activities for kids that you can try to incorporate into your routine.

Involve them in budgeting

There aren’t any money management and and financial literacy activities as crucial to a child’s growth as budgeting, especially since most kids don’t quite understand their parents' spending and finances. There are sometimes good reasons for this—children should not know all your financial struggles.

That being said, if you’re the kind of parent who creates a weekly or monthly budget, consider showing your kids how you create one. Explain some of the simpler expenditures your money goes to, such as shopping or bills. Strengthen their math skills while giving them an appreciation for money and what it does for their family.

Give them an allowance

Letting your child earn an allowance can set them up with impressive financial aptitude as adults. Consider that earning their allowance will be a child’s first experience with having an income, and there will be plenty of things kids will be excited to buy.

That’s good! Childhood is a time to learn positive experiences, so they shouldn’t have to worry about bills and other expenses. They’ll quickly learn the value of their money and the satisfaction of saving to get the things they really want.

Set up a money jar

Money jars are a great way to save up the extra change we accumulate throughout our lives. We tend to undervalue our coins nowadays, especially as many of our finances are handled online now, but they have a lot of value in terms of giving kids tangible lessons about money.

The jar could be associated with other behaviors you’re trying to teach, too. We all know about swear jars, but your kid will hopefully not need one of those for a while. Instead, put a coin in when they do something good; this positive reinforcement is more likely to foster good behavior.

It might be a year or more before a large jar is filled to the brim with coins, but going to the coin machine to get some well-earned cash from it will be worth it. As a bonus, your kids will appreciate it if they ever live in a building with coin-operated laundry machines.

Take them on grocery trips

The rising costs of food due to inflation are hard on many, so eating more for less is always an invaluable skill to pass on. The grocery store can be a very intimidating and overstimulating place for some kids, but taking them along can be worthwhile in the long run. Letting them help make the shopping list can also encourage them later on in life to budget their spending when it’s their own money being spent.

Help them run a lemonade stand

The classic lemonade stand can be a bit tricky to pull off, but it’s very rewarding. Help your kids run their first business for a good cause or valuable education. The great thing about lemonade is that it’s actually quite cheap to make, so even selling cups for a dollar is making a great return on their investment. Encourage your kids to consider how spending money smartly can earn them more back with a little hard work and business finesse.

The earlier kids learn about money, the better they’ll manage it as adults

Kids and adults will make mistakes with money sometimes, but learning from them can be an invaluable experience. Money can be a confusing concept for many kids to fully appreciate. Teaching them early in their lives to value it and make smart financial decisions will always pay off in their futures, and they’ll have a lot to appreciate your teachings for.

Solitaire Games

More Solitaire Games

More Games

Solitaire News

Disclaimer

DISCLAIMER: The games on this website are using PLAY (fake) money. No payouts will be awarded, there are no "winnings", as all games represented by 247 Games LLC are free to play. Play strictly for fun.